capital gains tax changes uk

The rate at which you pay Income Tax denotes which rate you pay for Capital Gains Tax. Add this to your taxable.

Capital Gains Tax Low Incomes Tax Reform Group

2 minute read November 3 2022 1106 PM UTC Last Updated ago UK considers cutting tax-free dividend allowance increasing capital gains tax -media.

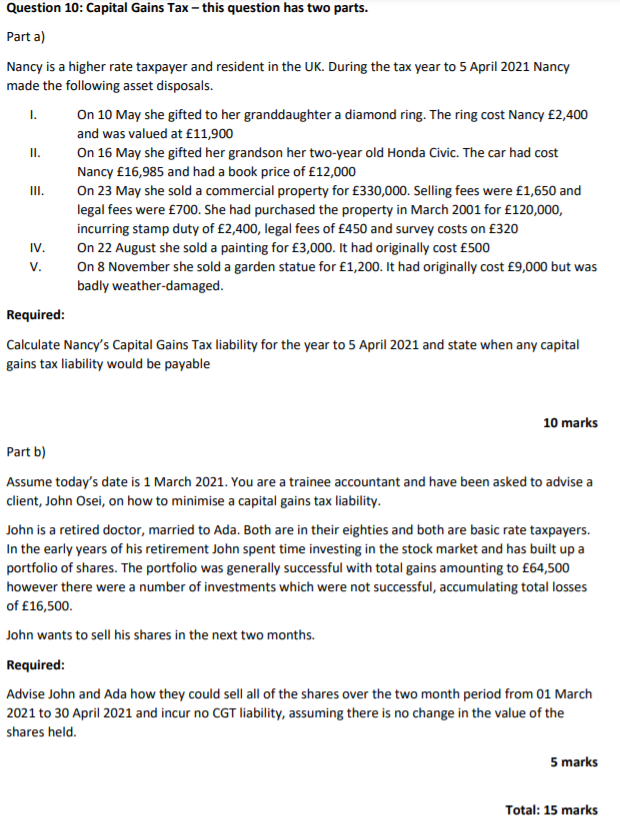

. There is a special 10 rate that can only apply to gains with respect to which a valid ER claim has been made. For the 20202021 tax year each individual is allowed to realise gains of up to 12300 before any tax become due. If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners.

The annual exempt amount for individuals and personal representatives remains 12300 for 202223 and the annual exempt amount for. As the Chancellor is weighing up difficult decisions to address a 50bn black hole in the public finances Jeremy Hunt is looking at raising taxes on the sale of assets such. Make investments in Isas as any gains are tax-free.

First deduct the Capital Gains tax-free allowance from your taxable gain. Its the gain you make thats taxed not the. 18 and 28 tax rates for individuals.

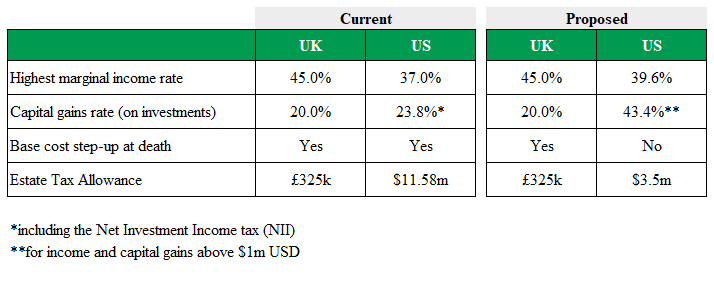

Rates of capital gains tax range from 10 to 28 depending on the income of the taxpayer and the type of asset sold. The UK government introduced non-resident capital gains tax NRCGT which applies to all non-UK residents including individuals trusts and companies. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value.

Any gain over that amount is taxed at what. The capital gains tax CGT system could be made simpler and fairer by reducing the annual exempt amount and raising rates to match income tax according to a recent report. The changes in tax rates could be as follows.

The Chancellor is considering an increase in the headline rate of capital gains tax CGT and taxes on dividends at the Autumn Statement. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. The following Capital Gains Tax rates apply.

The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020. This could result in a significant increase in CGT rates if this recommendation is implemented. Annual exemption and rates of tax.

If CGT and Income Tax rates become more closely aligned the government could also consider. Trustees and personal representatives are subject to tax at the fixed rate of 28. The separating spouses or civil partners will.

There is currently a. From 6 th of April. In summary the following CGT rate changes have been enacted.

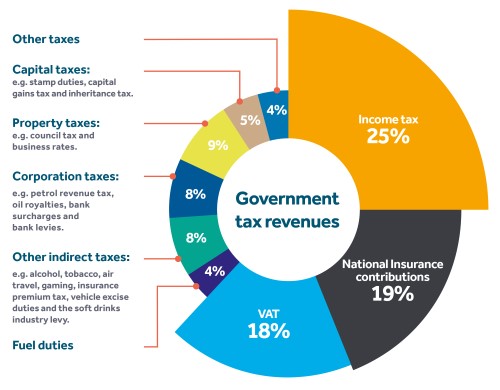

For non ER disposals occurring on or after 23 June 2010. Reduce your taxable income. 2 days agoThats about 15 of all UK tax receipts.

10 and 20 tax rates for individuals not including residential property and carried interest. The same change will also apply for non-UK residents disposing of property. Chancellor weighs up rise in capital gains tax in bid to fix 50bn black hole - Jeremy Hunt is also considering an increase in dividend taxes in a move that would come as a blow to entrepreneurs.

Jeremy Hunt is considering raising capital gains tax and slashing the dividend allowance as he seeks to fill the 50bn chasm in the nations finances reports suggest. Mr Hunt is examining changes to the. Basic rate taxpayers would also see bills increase from 18 to 20.

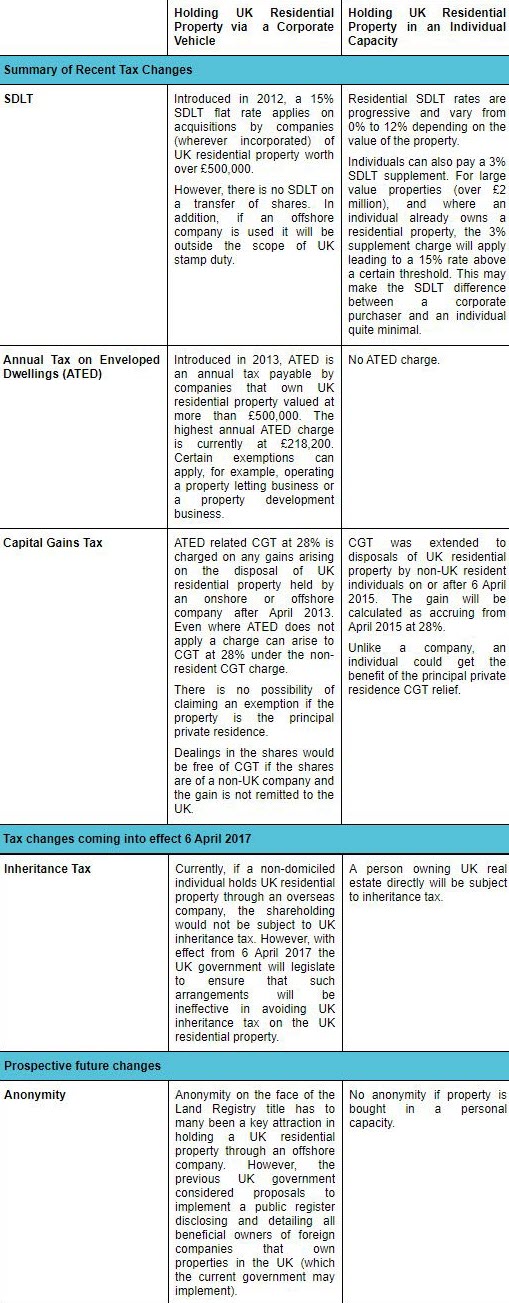

The proposed rules for disposals on or after 6 April 2023 will introduce a much more favourable tax treatment. Capital gains tax reporting extended Another announcement in the Autumn Budget 2021 affects anyone who makes a capital gain after selling a property. Proposed changes to Capital Gains Tax.

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Using Corporate Structures To Own Uk Residential Property A Dead End

Ii Question 10 Capital Gains Tax This Question Chegg Com

Capital Gains Tax Changes In 2021 Budget To Come Into Force Personal Finance Finance Express Co Uk

What Overseas Investors Need To Know About The New Cgt On Commercial Property Allsop

The Law Society Of Northern Ireland Https Www Eventbrite Co Uk E Capital Gains Tax Current Changes Registration 131857887491 Facebook

Post Covid 19 Tax Planning Be Prepared For Tax Rises Cgwm Uk

Taxing Capital Gains At Ordinary Rates Evidence Says Do It So Does Buffett Jared Bernstein On The Economy

What Are Capital Gains Taxes And How Could They Be Reformed

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

Tax Free Capital Gains How Non Residents Can Protect Most Of Their Property Profits From Tax Bayley Carl 9781907302954 Amazon Com Books

Will Capital Gains Tax Rates Increase In 2021 Implications For Business Owners Bdo

How A Carbon Capital Gains Tax Can Curb Emissions

Changes To The Taxation Of Residential Real Estate Capital Gains Tax

Managing Tax Rate Uncertainty Russell Investments

Hmrc Tax Rates And Allowances For 2022 23 Simmons Simmons

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget