www.tax.ny.gov basic star exemption

To be eligible for a STAR check you must register with the New York. The following security code is necessary to.

Enter the security code displayed below and then select Continue.

. To apply to STAR a new applicant must. STAR helps lower property taxes for eligible homeowners who live in New York State school districts. All New Yorkers who own and live in their one- two- or three-family home condominium cooperative apartment mobile home or farm home are eligible for the STAR tax cut on their.

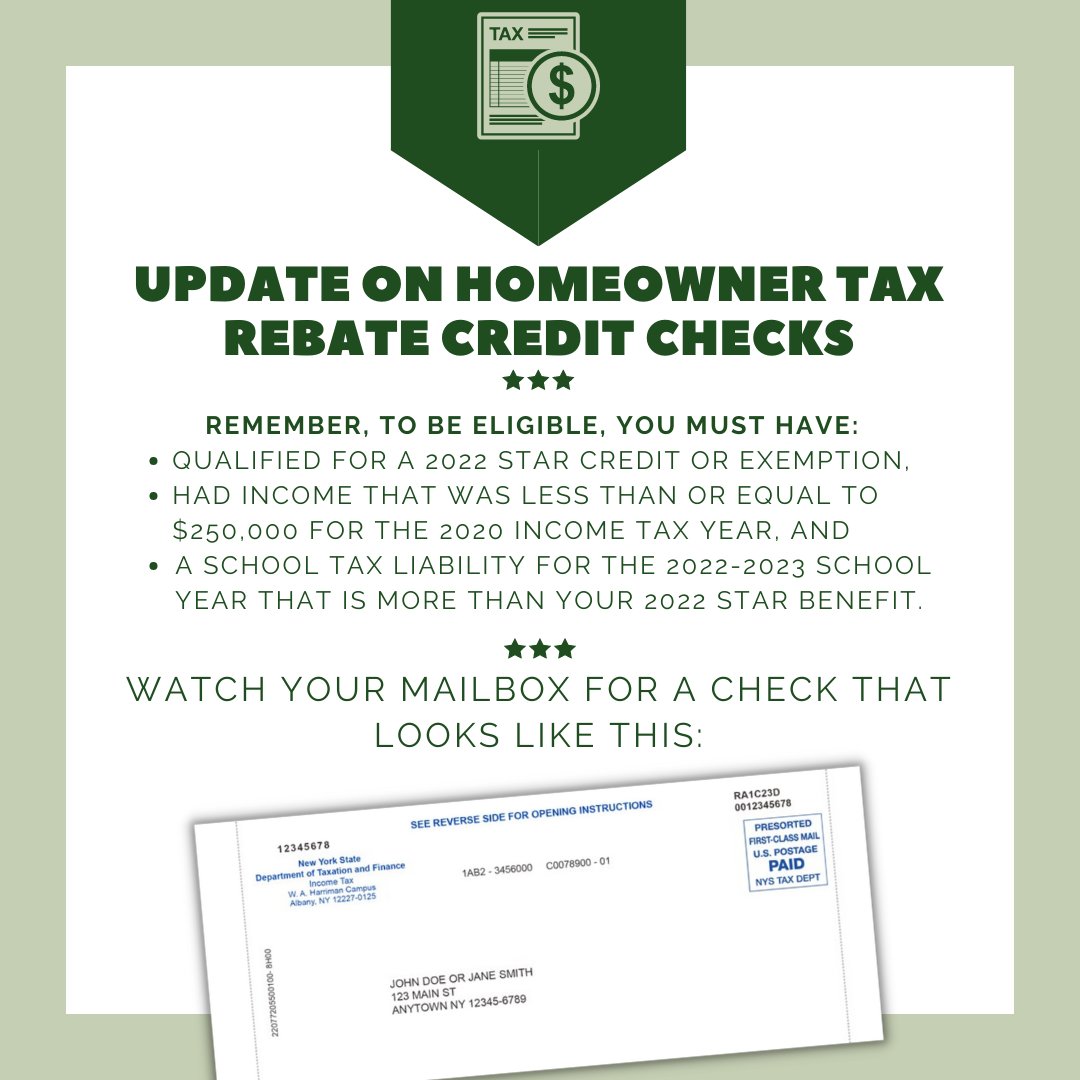

Star School Tax Relief Basic Exemption. The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners. More than 17 million New York homeowners have registered for their Basic STAR property tax exemptions.

To qualify the adjusted gross income must be under the State. HOME IMPROVEMENT PROPERTY TAX EXEMPTION STAR is the New York State School Tax Relief program that provides an exemption from school property taxes for owner-occupied. Use Form RP-425.

You currently receive Basic STAR and would like to apply for Enhanced STAR. Available if you own and occupy a residential property with federally adjusted gross income. The deadline to file for all exemptions is March 1.

STAR Tax Exemption Registration. Below you can find a guide to frequently asked questions about the. To be eligible for Basic STAR your income must be 250000 or less.

To learn more about STAR. Enter the security code displayed below and then select Continue. Basic STAR is for homeowners whose total household income is 500000 or less.

The following security code is necessary to prevent. You may be eligible for Enhanced STAR if. Resident homeowners applying for STAR for the first time are not affected by this years registration procedure.

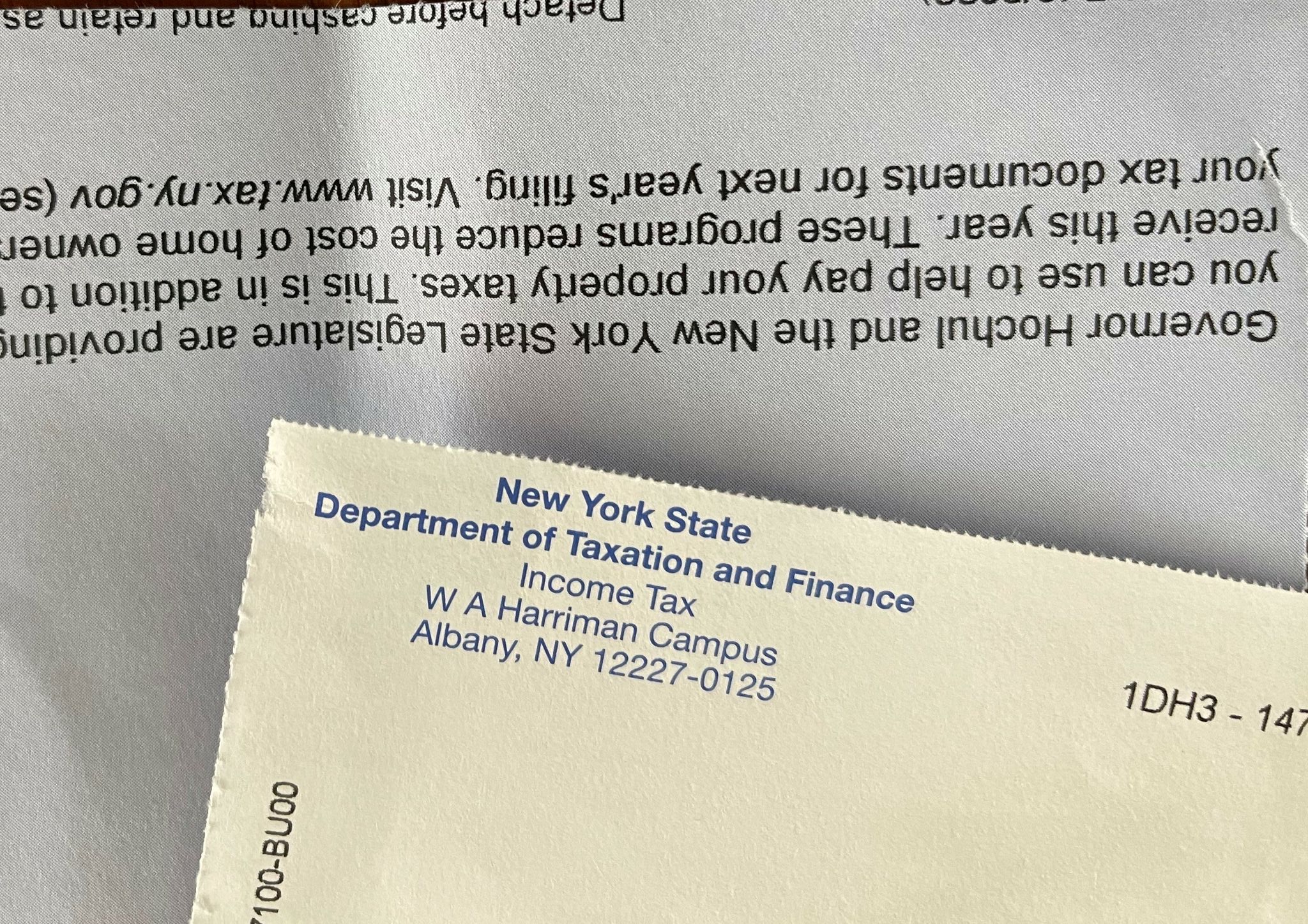

A manufactured homeowner who received a letter that you must register for the STAR credit to continue receiving a STAR benefit Form RP-425-RMM. STAR Check Delivery Schedule. If they qualify they will receive a STAR credit in the form of a check rather than receiving a property tax exemption.

If qualified you will receive a STAR credit in the form of a check rather than a property tax exemption.

Irs Name Change Letter Sample Letter To Irs Free Printable Documents Address The Recipient By Name And State Letter Sample Name Change Business Template

Pros And Cons Self Managed Condo And Co Op Buildings In Nyc Hauseit Condo Buying A Condo Building

Rasheed N C Wyatt Rashwyatt Twitter

Receiver Of Taxes Town Of Oyster Bay

Employee Raise Form Unique 7 Free Salary Increase Templates Excel Pdf Formats Salary Increase Proposal Letter Letter Templates Free

Karl Hubenthal Illustrator Vintage Football Sports Art American Football League

Condo Closing Timeline Nyc Hauseit Nyc Condo Buying A Condo

New York Property Owners Getting Rebate Checks Months Early

The School Tax Relief Star Program Faq Ny State Senate

Enhanced Star Income Verification Program Ivp Enhancement Stars Income

New York Property Owners Getting Rebate Checks Months Early

What Is The Enhanced Star Property Tax Exemption In Nyc Nyc Condo Buying A Condo Property Tax

Social Media Marketing Social Media Social Media Marketing Marketing Support

Ny Stimulus Payments Amount And Eligibility For This Tax Rebate Marca